WisdomTree: Time to capitalise on value in Europe

WisdomTree: Time to capitalise on value in Europe

By Aneeka Gupta, Director, Research, WisdomTree

European equity markets have staged a strong rally over the past 12 months gaining 39.3%[1] and are now catching up with underlying macro-economic data. The International Monetary Fund (IMF) has increased its forecasts of Eurozone GDP to 4.4% for 2021 and 3.8% for 2022, compared with its projections three months back of 4.2% and 3.6% respectively[2].

According to the Citi Economic Surprise Index[3], European macro-economic data has staged a turnaround outpacing the US since November 2020. However, Europe’s equity market performance has sharply underperformed global peers – US, MSCI World Value and Japan by 15%, 6.4% and 21% respectively[4] leaving some room for a sustained rally.

The EuroStoxx 600 Index’s forward Price-to-Earnings Ratio (P/E ratio) has fallen from a record high last June as a surge in earnings forecasts has outpaced the stock gains[5]. As we emerge from the pandemic, Europe will be an attractive opportunity for three main reasons:

- Global recovery favours Europe’s export reliant economy

- Easing of restrictions to benefit Europe’s cyclically sensitive stocks

- EU’s recovery fund to bolster its revival

Global recovery favours Europe’s export reliant economy

In the post vaccine phase of the recovery, we expect a broadening global recovery to favour Europe as it is more exposed to global trade. Exports account for 28% of eurozone GDP compared to only 12% in the US, 18% in Japan and 19% for China.

According to the Eurostat, China became Europe’s main trading partner last year, overtaking the US. Imports from China in 2020 grew by 5.6% year on year (yoy) to €383.5Bn and exports increased by 2.2% to €202.5Bn.

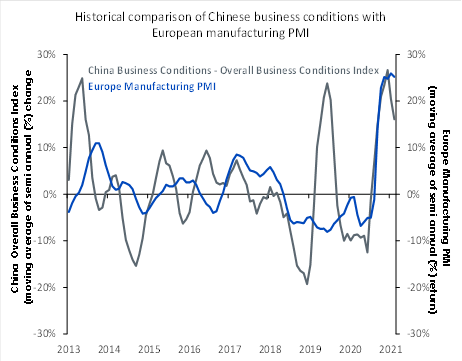

The faster recovery of the Chinese economy compared to the rest of the world is subsequently poised to benefit Europe. The strong advances in the manufacturing sector in Europe have moved in tandem with improvement in China’s business conditions index evident from the chart below. Activity in the manufacturing sector in March expanded the most in 23 years offsetting continued weakness in the services sector.

China’s recovery in the second half of the year aided a consistent demand for European products in the cyclically sensitive automotive and luxury goods sector. In 2020, China was Germany’s second biggest export destination according to the Federal Statistical Office.

PMI: Purchasing Managers Index. Source: WisdomTree, Bloomberg as of 31 March 2021. Historical performance is not an indication of future performance and any investments may go down in value.

Easing of restrictions to benefit Europe’s cyclically sensitive stocks

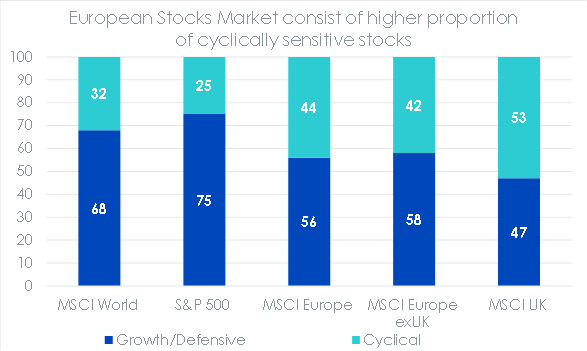

European stock markets are known to contain more cyclically sensitive stocks illustrated in the chart below.

Source: WisdomTree, FactSet, MSCI, S&P as of March 2021.[6]

Europe’s higher exposure to financials and cyclically sensitive sectors such as industrials, materials and energy are likely to benefit from pent up domestic demand as the lockdown measures ease.

Rising bond yields and inflation expectations may bolster rate sensitive financial stocks. In the fourth quarter 2020 earnings season, among the 59% of companies that have beaten Earnings per Share (EPS) estimates by 5% or more, we found industrials and financials posted the best breadth of beats at the sector level[7].

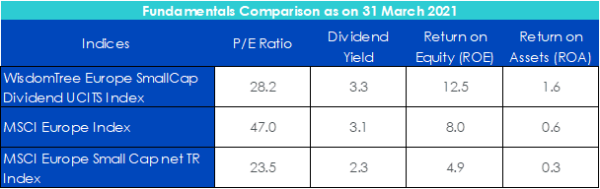

The WisdomTree Europe SmallCap Dividend UCITS Index lays a strong emphasis on value investing owing to its unique methodology of weighting companies by their contribution to the Dividend Stream. It aims to deliver two important factors such as quality and value as it screens for companies with efficient operations, strong balance sheets and healthy fundamentals. From a valuation perspective, European small cap stocks are trading at a 40% discount in comparison to large caps[8].

Source: Bloomberg, WisdomTree, data available as of close 14 April 2021. Historical performance is not an indication of future performance and any investments may go down in value.

EU’s recovery fund to bolster its revival

The other source of support towards Europe’s revival is the rollout of the EU recovery fund, equal to 5% of GDP[9]. The fund is set up to run over 6 years between 2021 until 2026, to fuel spending needed to overcome the damage caused by the pandemic. The disbursements are due to start later this year and accelerate through 2022 and 2023, enabling a useful sustained fiscal boost to growth.

Conclusion

The slow vaccine rollouts are delaying the easing of restrictions within Europe but are unlikely to derail European stocks performance over a long-term horizon. The EU is poised for a big ramp up in supplies in April and May while large vaccination centres have been set up across the region. The vaccine rollout will gather pace and Europe’s trailing relative performance to the rest of the world, should provide impetus to its recovery in the second half of this year.

[1] EuroStoxx 600 Index from 14 April 2020 to 13 April 2021

[2] International Monetary Fund

[3] Citi Economic Surprise Index measures data surprises relative to market expectations

[4] US: S&P 500 Index; MSCI World Value Index; Japan: Nikkei Index from 14 April 2020 to 13 April 2021

[5] Euro Stoxx 600 Index

[6] Please note: Cyclicals include energy, financials, industrials, and materials. Growth/Defensive includes communication services, consumer discretionary, consumer staples, healthcare, technology, real estate, and utilities.

[7] Bloomberg

[8] P/E: Price to Earnings ratio

P/E of European small cap stocks represented by WisdomTree SmallCap Dividend UCITS Index is 28x

P/E of European large cap stocks represented by MSCI Europe Index is 47x

[9] Factset, WisdomTree