Columbia Threadneedle Investments: Knowns and unknowns after a tumultuous year - 2021 Market Outlook

Columbia Threadneedle Investments: Knowns and unknowns after a tumultuous year - 2021 Market Outlook

London, 3 December 2020: After a tumultuous year and with significant uncertainty ahead, William Davies, Chief Investment Officer, EMEA at Columbia Threadneedle Investments, outlines his outlook for 2021.

- We see three themes dominating the investment landscape in 2021: the development of a Covid-19 vaccine; the political make-up of the US following the November election; and Brexit.

- Following unprecedented levels of stimulus and government intervention the level of debt is going to be even greater than it was after 2009 and we will emerge into a world of low inflation, low growth and low interest rates – such a backdrop is not one where traditional value investing is likely to outperform over the longer term.

- Instead, this environment will favour the type of investments that Columbia Threadneedle Investments makes – long-duration assets and durable growth companies that keep grinding higher because they have all the characteristics we look for in a business: sustainable returns driven by a sizeable moat, a high Porter's Five Forces score, strong environmental, social and governance credentials and sustainable competitive advantage.

- Looking at specific equity markets, it is a question of short term versus long term. The UK is clearly cheaper than other markets around the world and may benefit if we see the recovery that we expect to see over the next 9-12 months; and Europe is in a similar position, as indeed is Japan. Longer term, we can see further potential in the US and Asia/emerging markets.

- We like an element of risk within credit, but we believe investment grade is ultimately a better home for it than high yield, where we see a greater risk from higher financial leverage, which is particularly dangerous if coupled with high operational leverage.

- As active managers we have performed strongly throughout the pandemic crisis, using our knowledge, expertise, collaborative skills and research capabilities to remain calm. This consistent approach will continue to be followed in 2021, helping us identify trends and investment opportunities, whatever next year may bring.

Covid-19: the search for a mass vaccine nears its end

When the coronavirus first hit, our research work was focused on its potential spread, because that had impacts at a corporate level as well as a personal one, from travel and healthcare to banks and retail. While the data we had available was limited to the number of tests, hospitalisations and deaths, our research teams focused on diagnostics, treatment and vaccine development. Looking forward it is important to focus on when successful vaccines will be available, how effective they may be and who will receive them.

It is all about knowns versus unknowns. We know three vaccines have already been announced with 90%-plus efficacy rates (impressive given that vaccines are usually approved if they have 50% efficacy), but we do not yet know the full differences between these vaccines. We know there will be a rapid uptake from the general public, but we do not know the extent to which there will be hesitancy from certain sub-groups.

We know that while the end of the pandemic is coming, the fundamentals are likely to deteriorate first because many economies are still shutting down – it is getting worse before it gets better.

Markets have begun to look through the short-term to the sunny upside of the vaccine-led recovery. Where previously they appeared vulnerable to any spike in positive tests or hospitalisations, now they appear more sanguine.

But what will that recovery look like? In April, our original forecast was that the recovery would be U-shaped and we would see a level of economic activity back at pre-pandemic levels by the end of 2022. However, the strong efficacy of the drugs from Moderna et al would encourage us to believe that the recovery from the pandemic may be quicker in 2021 than we had previously anticipated.

That should bring forward the economic recovery by as much as nine months, meaning we see a recovery to pre-pandemic levels by early-2022 or possibly even the end of 2021. The critical thing for us is to ensure we remain invested in the companies that are going to make it through and ultimately benefit from the economy reopening.

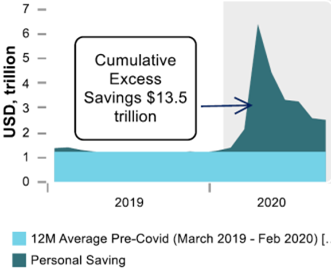

Since the pandemic and lockdowns we have seen consumers become more comfortable buying things online that they had traditionally resisted, such as clothing and footwear. As a result, the trend towards e-commerce has been pulled forward. If you add to this the build-up of personal savings caused by people being unable to spend as much as they used to, you have a potential explosion of pent-up demand to come in 2021 (Figure 1). In our view, the greatest growth in spending will more likely be on “experiences” hit during the pandemic (for example, leisure and travel) rather than “things” (washing machines and cars), which was a consumer trend we had been witnessing for some years already.

Figure 1: US savings rocket

Source: Hutchins Center calculations from Bureau of Economic Analysis data, as at November 2020.

That said, there is a subtlety to the recovery that we must heed. It could be a mistake to believe people will begin flying to places and staying in hotels at the same rate as before. With the digitisation of the economy and the use of video conferencing, for example, there is a strong case that business travel and spending will not return to pre-pandemic levels. As a result, certain hotel groups and airlines that are geared towards business may not do as well as more leisure-focused airlines as we emerge from our Covid-19 hibernation.

US political landscape: healthy for equities and credit?

Joe Biden’s victory in November looks to have delivered a divided US government, though there is still a run-off election in Georgia that could yet see the Democrats with marginal control of the Senate as well as the House of Representatives.

The implications of this are threefold. Firstly, Biden appears to be a more stable, consistent leader and we anticipate he will more likely heal domestic divisions as well as repair international relationships. He has talked about rejoining the Paris climate accord, for example, and this will have a positive impact on slowing climate change and aligning the US with other nations. We also expect him to continue taking a tough line on China, but with a different style to the rhetoric and a more consistent approach. Biden will no doubt have a more constructive relationship with Europe too, and Germany and France in particular, which has deteriorated in the past four years.

We also expect a continuation of the status quo (certainly with regard to tax), which is one of the reasons the market reacted so positively to recent vaccine news: as well as the positive implications this brings, investors were also parsing the fact that Biden will be unlikely to increase tax to the extent he had noted while campaigning due to the likely make-up of the legislature. This reversed investor fears that companies might have to take a 5%-10% haircut to earnings if the tax rate were to rise.

On the flipside, with a split Congress Biden’s plans to inject stimulus in the form of a huge infrastructure bill also appears to be off the table, despite the fact both sides have indicated support for it in the past.

We thus find ourselves in something of a middle ground, which is a reasonably healthy position for equity and credit markets, and certainly one that benefits the likes of US utilities, consumer staples, real estate and tech, but which may have negative implications for financials, energy and health care.(Financials and energy are likely beneficiaries from the recovery/vaccine, but not as much as if stimulus were greater).

Brexit: negotiations reach a climax

This is a more localised issue, but could have far broader implications, incorporating any trade relationship between the UK and the US, and with Europe.

With the Brexit deadline of 31 December 2020 looming, we ought to know soon whether both sides have finally come to an agreement, failed or procrastinated sufficiently to the point where they allow each other to break the rules and extend negotiations. The most likely outcome is that they will come to some sort of agreement – even if elements of that agreement include decisions still to be agreed.

This leads me to the UK equity market, for which 2021 is hugely important. The UK has endured an extremely challenging period, buffeted by ongoing Brexit uncertainty, political upheaval and the pandemic. Companies in the UK appear cheap, which is evident in the rising number of takeovers and mergers and acquisitions. With that in mind, I believe any positive news –be that vaccine-related, Brexit or otherwise – could open the door for a stronger performance from UK equities in 2021.

Markets opportunities: quality set to endure

At the end of the global financial crisis in 2009 we saw a sugar rush within markets, specifically for a couple of quarters from March that year where economy-sensitive stocks performed very well. This is being mimicked somewhat today but, following unprecedented levels of stimulus and government intervention, the level of debt is going to be even greater than it was after 2009, so that rush of recovery is unlikely to persist. We will thus emerge into a world of low inflation, low growth and low interest rates – a repeat of the 2010s in some way. Such a backdrop is not one where traditional value is likely to outperform over the longer term.

A big fiscal deficit is of course potentially inflationary, but any inflation is unlikely to persist for two reasons: one is that there is a lot of spare capacity within the economy, as measured by unemployment and low industrial capacity utilisation; and secondly, any inflation will be accompanied by rising interest rates which will quickly dampen growth due to the cost of servicing such high levels of debt.

We would therefore caution against a rush to value and poorly performing stocks irrespective of the outlook, and would also caution investors about value traps.

Instead, this environment will favour the type of investments that Columbia Threadneedle Investments makes – long-duration assets and durable growth companies that keep grinding higher because they have all the characteristics we look for in a business: sustainable returns driven by a sizeable moat, a high Porter's Five Forces score, strong environmental, social and governance credentials and sustainable competitive advantage.

Volatility will likely continue to be elevated in 2021, but it would be a mistake to make knee-jerk reactions to sudden strong moves in markets. Again, as investors we must maintain our strategic positions and focus on the longer term. We want risk within portfolios, but we want controlled risk.

Regional Equities

Investors must be prepared for current secular trends such as digitisation and automation to continue, while the growth of e-commerce has been pulled forward by the pandemic. The stocks benefiting from these trends continued to outperform in 2020 and we expect them to do so in the future. We also expect cyclical areas that were hit by Covid-19 to bounce back when the recovery kicks in, including travel and entertainment. That said, investors should not ignore the companies which might have underperformed during the pandemic but have the financial strength and the business models to gain market share on the other side.

Looking at specific regions, it is a question of short term versus long term. The UK is clearly cheaper than other markets around the world and may benefit if we see the recovery that we expect to see over the next 9-12 months; and I would put Europe in that camp too. Longer term, we can see potential in the US and Asia/emerging markets.

In the US we see a market which is broader than other markets around the world and in the case of the technology sector is a leader in terms of digitalisation around the world, but we see its recovery taking longer.

As ever with emerging markets, there are those countries where we see growth ahead, and others where we see challenges, such as with Brazil or India (although they a smaller part of the emerging market investment landscape). The largest emerging market is of course China, which is growing this year and was the first to emerge economically from Covid-19. Other countries are at different stages of their recovery, and this will be linked to how quickly mass vaccinations are rolled-out, but we see China at the forefront and the likes of India and Latin America further behind.

In Japan we would look at Prime Minister Shinzo Abe’s replacement, Yoshihide Suga, as being very much the continuity candidate. He has made positive noises about continuing on the path that has seen the country embrace corporate governance and regulatory reform, digital transformation, and a more attractive environment for foreign tourists and workers. Japan has significant exposure to industry within its market – particularly to Chinese investment – so we see an improved outlook for Japanese equities going into the recovery, even if Japan’s demographics do continue to create a real headwind.

Credit: preference for investment grade

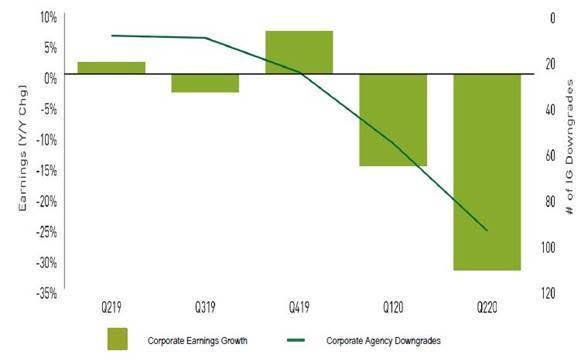

Investment grade markets benefited directly from fiscal stimulus such as corporate bond-buying programmes and furlough schemes. We do see some downgrade risk when those props are removed, but there is a greater risk in the high yield area where investors must tread carefully due to higher financial leverage. Not all those companies are going to make it through – indeed, if high financial leverage is linked to operational leverage, which it often is, one should tread ever so carefully (Figure 2). So while we like an element of risk within credit, we believe investment grade is ultimately a better home for it than high yield.

Figure 2: lower profits and higher downgrade activity expected

Source: S&P Global Market Intelligence, Bloomberg and Moody’s as at September 2020.

Active managers powered by research

Our research teams work collaboratively across all major asset classes, using big data and analytics such as machine learning and augmented intelligence to turn information into forward-looking insights that add real value to investment decisions, enabling consistent and replicable outcomes for our clients. Research Intensity is at the heart of our investment process.

This year we have focused our research on Covid-19 and its impact, including the health care impacts, economic and market impacts, and long-term implications. This has helped inform our view of how we see the trajectory of the virus, vaccine development and economic recovery. We call this inter-linking of our analysts and research team with our fund managers to create well-argued and sensible views the “path forward”. It has given us insights throughout the year that have allowed us to add value for our clients.

As active managers we have performed strongly throughout the pandemic crisis, using our knowledge, expertise, collaborative skills and research capabilities to remain calm. Whatever 2021 brings, this approach, coupled with our experience of 2020, means we will be particularly well-positioned to navigate through financial markets for our clients.