WisdomTree: Gold to regain lost ground and reach fresh highs

WisdomTree: Gold to regain lost ground and reach fresh highs

By Nitesh Shah, Director, Research, WisdomTree

After rallying to new highs on 6th August 2020 of over US$2070/oz intraday, gold prices have fallen close to 10% by September 24th 2020. Year-to-date, gold is still up over 22% and most importantly it is one of the very few assets posting gains during the worst of the COVID-19 pandemic driven crisis. The recent drawdown of gold comes at a curious time when inflation expectations are rising, the US dollar has been weak and when we haven’t really escaped the economic uncertainty that the COVID-19 pandemic has brought about.

The cyclical market drawdowns we have seen in the past month may be placing downward pressure on defensive assets like gold and Treasuries, just as we saw back in March 2020. At that time investors were redeeming liquid assets due to pressure in other parts of their portfolio. If gold is viewed as only a defensive asset, then a cyclical recovery may hurt prices. However, historically gold has not just been a defensive asset. Its price tends to rise with inflation which is generated during periods of stronger economic growth. So long as recovery is not met by an aggressive tightening of monetary policy, gold is likely to do well.

Our internal forecasts for gold in the coming year indicate the recent price decline in gold has opened up an attractive entry point, especially if economic uncertainty persists.

Scenarios using WisdomTree’s framework

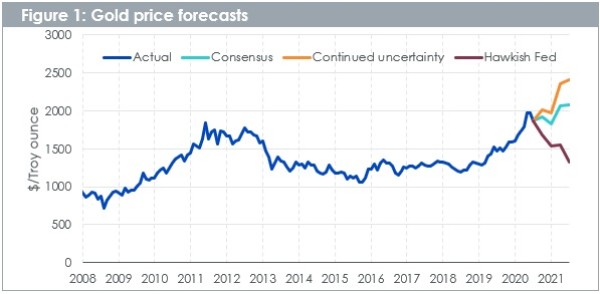

Using our model framework, we provide some scenarios for gold prices until Q3 2021.

Source: WisdomTree Model Forecasts, Bloomberg Historical Data, data available as of close 23 September 2020. You cannot invest directly in an index. Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

In the figure, we show 3 distinct forecasts:

- Consensus - based on consensus forecasts for all the macroeconomic inputs and an assumption that investor sentiment towards gold remains flat at where it is today

- Continued economic uncertainty – Further monetary intervention – possibly through yield curve control – limits Treasury yields and the US dollar continues to weaken, while investor sentiment towards gold strengthens

- Hawkish Fed – despite having adjusted its inflation target, the Federal Reserve (Fed) behaves hawkish and Treasury yields rise substantially, the US dollar appreciates back to where it was in May 2020 and inflation remains way below target. As US dollar debasement fears recede, positioning in gold futures declines.

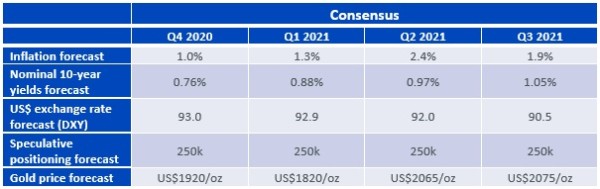

Consensus

Consensus has adjusted to the Federal Reserve’s new inflation targeting regime, where the central bank looks at average inflation and thus will let inflation rise above 2% to compensate for periods when it has been below. Consensus is looking for interest rates to remain on hold for the coming year. Indeed, the Fed’s dotplots indicate that policy interest rates will remain on hold until 2023.

Consensus expects inflation to rise substantially above 2%, hitting 2.4% in the middle of 2021. In part that reflects rising energy costs after sharp declines earlier in 2020. But even core (PCE) inflation is expected to pick up from 1.3% currently to 1.7% in Q2 2021, indicating a more broad-based increase in prices.

Over the forecast horizon, the market expects 10-year Treasury yields to more than double from the 0.50% low reached in August 2020. That in part reflects the rising indebtedness of the US government. It does not appear that consensus is pricing in any Yield Curve Control here. The yield on Treasury inflation protected securities (TIPS) remains negative and very low at -0.93%. The widening differentials between real and nominal Treasury yields indicate higher inflation expectations.

Even though consensus is expecting rising Treasury yields in a market of flat policy interest rates, consensus expects US dollar depreciation to continue. This divergence between the US dollar and Treasuries is consistent with rising indebtedness concerns.

In the consensus case, we leave positioning in gold futures roughly where they are today (250k contracts net long) and so we are not pricing in any further bullishness for the metal in the scenario. Earlier in the year positioning peaked close to 400k contracts net long.

In this scenario, gold could rise to US$2075/oz, thus breaking a fresh high (albeit marginally above the previous high in August 2020).

Source: WisdomTree, data available as of close 24 September 2020. You cannot invest directly in an index. Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

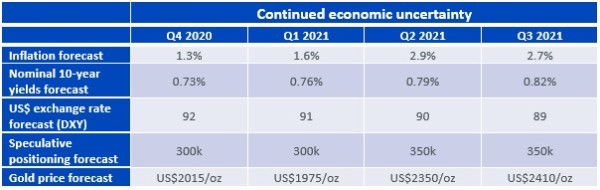

Continued economic uncertainty

The consensus view appears to be pricing in more economic stability and a continuation of the recovery that we have seen the last few months. However, with rising COVID-19 cases and an inability to fully dismantle social distancing rules until a vaccine is found, the Fed may have to provide even more monetary loosening in addition to the fiscal stimulus expected. One potential avenue is for the Fed to undertake Yield Curve Control. That is likely to constrain Treasury yields (relative to what consensus is expecting).

Inflation could peak just below 3% as the Fed’s actions generate more economic demand while supply remains constrained due to COVID related supply chain issues.

The looser monetary policy could also weaken the US dollar further than in the consensus case.

As the central bank experiments further with new monetary policy tools and we see US dollar debasement, investor sentiment towards gold increases and positioning in gold futures rises to 350k net long. The further negative real yields go, the greater the appeal of gold will become.

In this scenario, gold could rise to US$2410/oz, posting close to 30% upside from September 2020 levels.

Source: WisdomTree, data available as of close 24 September 2020. You cannot invest directly in an index. Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

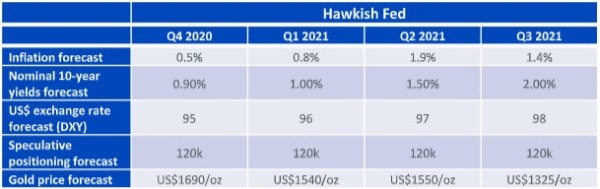

Hawkish Fed

In this scenario, we play devil’s advocate: what if economic conditions improve and the Fed is keen to keep inflation below 2% to anchor long-term expectations? Given that the Fed has recently changed its inflation regime, this scenario is the least likely but it’s worth exploring its implications.

Firstly, inflation will remain below 2% for the forecast horizon. Rising rates could see 10-year Treasury yields increase to 2% (i.e. four times higher than where we were in August 2020).

The US dollar could also appreciate if the Fed moves more aggressively than other central banks in tightening rates. Fears of US dollar debasement recede.

Assuming there is a genuine improvement in economic conditions that are not inflationary and the market doesn’t believe the Fed is making a policy error, positioning in gold futures could decline closer to its historic average.

In this scenario, gold could fall to US$1325/oz, retracing back to levels last seen in the first half of 2019.

Source: WisdomTree, data available as of close 24 September 2020. You cannot invest directly in an index. Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

We generally believe that economic uncertainty will persist during this unusual pandemic crisis that hasn’t been fully resolved yet. While the consensus scenario provides a path to regain gold’s lost ground, we believe that gold could rise substantially higher in the economic uncertainty scenario. We can’t rule out a scenario where the economy improves considerably. However, we are sceptical that the Fed would behave in a very hawkish fashion and, therefore, put a low probability to the hawkish Fed scenario.