MUFG: All to do about nothing, or something to come?

MUFG: All to do about nothing, or something to come?

By Derek Halpenny, Head of Research, Global Markets EMEA and International Securities

USD: Powell stays vague offering little new

The dollar remains broadly stable but at modestly stronger levels than yesterday’s lows that were recorded just after Fed Chair Powell made his remarks at the Jackson Hole remote gathering – a sell-off that made little sense to us considering the remarks made. We mentioned here this week the fact that there was a high level of anticipation about this speech and the significance it could mean for monetary policy going forward. History could still show that yesterday was a meaningful moment that signalled a substantial shift in the conduct of monetary policy in the US.

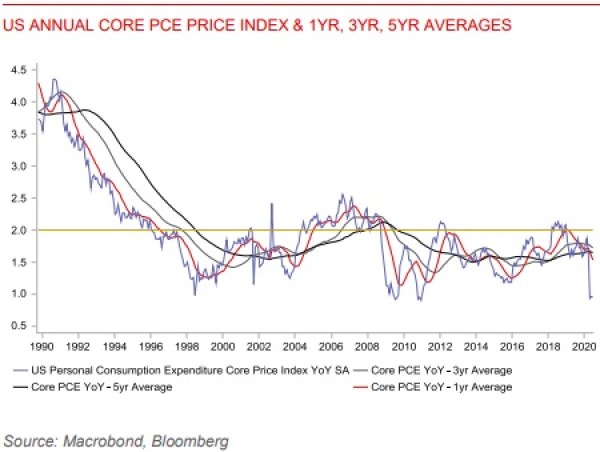

But to be honest there’s not a lot from yesterday that would give anyone much confidence in that prediction. Coinciding with Chair Powell’s speech, the Federal Reserve released a statement of approval to the updates to the Fed’s “Statement on Longer-Run Goals and Monetary Policy Strategy”. There were three changes highlighted by the Fed – 1) the policy decision would be informed by its “assessments of the shortfalls of employment from its maximum level”, whereas before the assessment was on “deviations from its maximum level”; 2) the inflation target policy of 2% would be achieved through a strategy that “seeks to achieve inflation that averages 2% over time”. This would mean that “appropriate monetary policy will likely aim to achieve inflation moderately above 2% for some time”; 3) the updated strategy explicitly acknowledged the challenges of monetary policy that would mean policy in the US and globally would be more “constrained by their effective lower bound than in the past”.

So the implication of the employment shift is the Fed has greater scope to allow higher levels of employment – there is a bias to respond to weaker levels of employment and keep policy looser when there is high employment (like just prior to the COVID shock). The inflation shift allows obviously for a longer period of policy stimulus that is expected to lift inflation to over 2%.

The third element sounds more like a frustration of the new reality than anything more meaningful. What was perhaps surprising with yesterday’s speech was the lack of focus on possible changes in policy implementation to meet the demands of this new policy framework. The lack of information on that disappointed the market and hence the reversal of the initial USD sell-off.

However, this full-blown conclusion to the Framework review (today could have been just an update with a completion perhaps in Sept) indicated by the Fed’s statement does open up the prospect of the markets getting more information on implementation strategy at the next FOMC meeting on 16th September. So while the Fed disappointed market expectations to some degree yesterday, the prospect of action in September will help to limit the scale of any renewed USD buying. The selling of the dollar today may reflect this reality. We have long argued we are heading toward some element of Yield Curve Control and our view has not changed. A specific move to Yield Curve Control still looks unlikely for now – that could be kept for a later day. However, we would be surprised if the Fed were to present this new strategy without understanding the need to show a change in its “reaction function” relatively soon afterwards. That prospect will keep the dollar on a weaker footing.

JPY: Deflation returning as Abe set to resign

We mentioned earlier this week the prospect of some increased volatility and temporary yen strength on a reaction to PM Abe’s resignation if that did indeed materialise. The last hour or so NHK is reporting that PM Abe will indeed resign due to health reasons. PM Abe had been set to hold a press conference at 10am London time but Kyodo News is reporting that PM Abe will officially tender his resignation to the LDP at 8am. We of course wish PM Abe good health in the future.

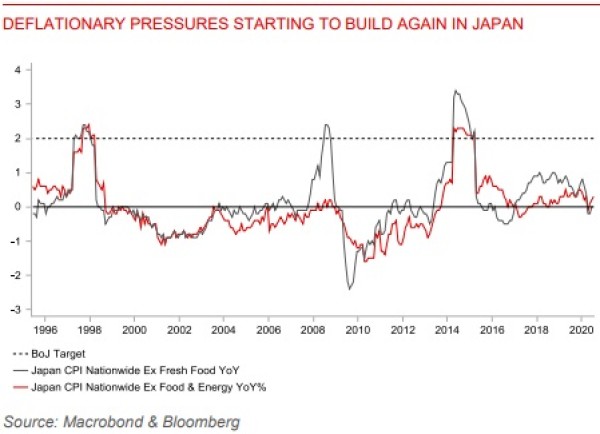

But there can be no denying that the timing of PM Abe’s departure is not particularly good. COVID has hit Japan hard like elsewhere and we continue to see emerging signs of the return of deflation to Japan. Today, CPI data for Tokyo revealed a drop in the core annual CPI rate from +0.4% in July to -0.3% in August. Japan had experienced its longest spell of positive inflation since the bubble burst and deflation emerged in 1995. The August reading was the steepest drop since March 2017. While a hotel discount campaign played a large role in the drop, excluding that impact inflationary pressures eased sharply in August. Deflation helps to lift real yields when nominal yields are at the lower bound and this has been a long-term supportive factor for the yen, and will be especially so now with the Fed trying to drive real yields lower through it monetary policy framework shift.

As stated here on Wednesday, PM Abe’s departure creates inevitable uncertainty on the outlook for ‘Abenomics’ but the essence of ‘Abenomics’ is the strong coordination between government and the BoJ and its aggressive monetary easing stance. That’s not going to change. Governor Kuroda remains in place until April 2023. Who takes over from PM Abe will be important but it is likely to be a continuity candidate. Yoshida Suga, the Chief Cabinet Secretary and Finance Minister Aso would signal policy continuity, more so Aso-san than Suga-san. The Topix fell over 2% quickly on the news and we can assume a bout of yen volatility too with upward pressure on the yen. But we suspect expectations of policy continuity for now will limit the near-term upside for the yen. A clearer picture may emerge following a statement from PM Abe later.