Fidelity: COVID-19 creates diverging paths for business

Fidelity: COVID-19 creates diverging paths for business

- Leading indicators across North America drop as COVID-19 cases spike, while optimism in Europe continues to rise

- Fidelity analysts point to negative outlook in financial sector

- Workplace diversity thrown into spotlight

Fidelity’s latest Pulse Survey of its in-house analyst team has found while leading indicators for businesses continue to trend upwards month-on-month, COVID-19 is creating increasingly diverging paths amongst regions and sectors.

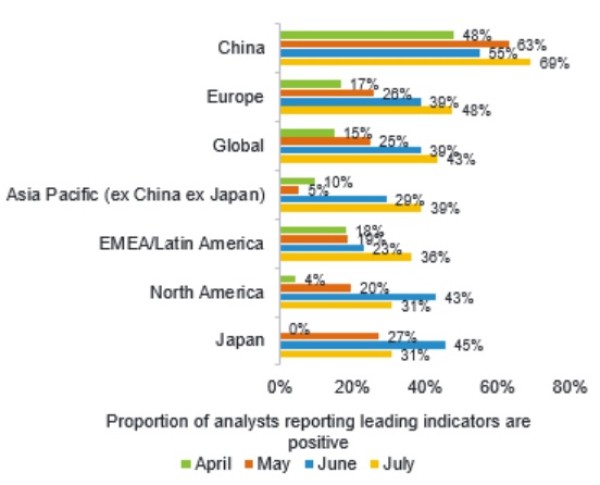

This month, 43 percent of Fidelity’s analysts reporting positive indicators globally, compared with 39 percent last month.

In North America, which has experienced a spike in Covid-19 cases in the last month, the proportion of Fidelity’s analysts reporting that leading indicators are positive dropped to 31 percent this month from 43 percent when asked in June.

Meanwhile, in Europe, which is gradually reopening as cases fall, optimism is on the rise. Almost half of analysts reported positive leading indicators, versus 39 per cent last month, while the scales tip slightly in favour of those expecting revenues to grow on a year-on-year basis over the next six months.

Chart 1: North America and Europe optimism diverges on virus concerns

Question: “Are leading indicators in your sector for the next 6 months positive or negative?”

Source: Fidelity International, July 2020.

Fiona O’Neill, Director, Global Research, Fidelity International comments: “While it is encouraging to see a continued rise in optimism from our analysts on the outlook for global businesses, it is clear the ability to get the virus under control is a deciding factor in our analysts’ assessments of future activity, as rising infections increase the risk of further economic lockdowns.”

Sectors rising but from low bases

At a sector level, despite management sentiment in the consumer discretionary sector showing some signs of optimism - 56 per cent of analysts report an improvement in sentiment this month - any revival is a sign of a gradual recovery from very low levels.

Sentiment in the energy sector tells a similar story, with 56 per cent of analysts noticing an improvement in management sentiment this month. However, optimism is not high in absolute terms, and 78 per cent of analysts expect a fall in year-on-year revenue growth over the remainder of 2020.

Finally, the financial sector is the only one where more analysts report leading indicators are negative than are positive – and this has been consistent for the past four months. Fifty-seven per cent of analysts expect revenues to decline in the next six months, due to an expectation of more muted medium-term growth rates which might weigh on the market and asset class returns for investors in all segments.

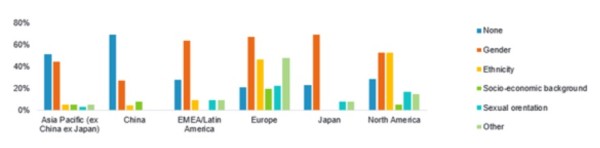

Workforce diversity becoming a priority

Beyond the financial impact of the pandemic, there is evidence of cultural change, with workforce diversity rising up the priority list in Japan, Europe, EMEA/Latam and North America.

Chart 2: Shifting attitudes to workplace diversity

Question: “In which of the following areas are you seeing evidence of your companies trying to increase workforce diversity?”

Source: Fidelity International, July 2020. Note: Analysts can select more than one answer choice

Fiona O’Neill added: “COVID-19 continues to force ESG issues, such as workplace diversity, into the spotlight. In Japan the focus is on gender diversity, with the majority of analysts reporting evidence of attempts to improve the gender balance in companies. Meanwhile, in North America, around half of analysts report an increasing focus on ethnic diversity, as company managements digest the impact of the Black Lives Matter movement.”