WisdomTree: Not quite a V-shaped recovery

WisdomTree: Not quite a V-shaped recovery

By Mobeen Tahir, Associate Director, Research, WisdomTree

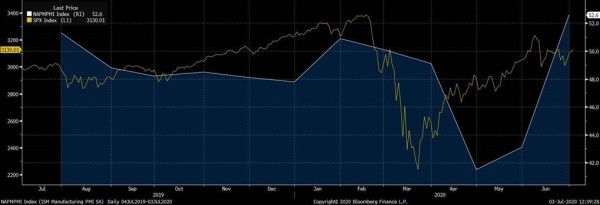

It is useful to follow economic data. But caution is warranted. The Purchasing Managers Index (PMI) is a helpful indicator to gauge the state of the economy. A reading above 50, at any point in time, signals that economic activity is expanding whereas a reading below 50 signals contraction. The Manufacturing PMI for the United States has surged past 50 – recovering strongly from where it was in April and May. Another encouraging data point is the addition of 4.8 million jobs in the US economy during June after 2.5 million jobs were added in May.

The equity market reaction

This is positive news for equity markets. During a 4-day working week in the US last week, the S&P 500 Index was up over 2.5% while the NASDAQ Composite Index was up over 3.4%.

Figure 01: PMIs join US equities to create a V-shape

Source: Bloomberg, Data from 04/07/2019 to 03/07/2020. NAPMPMI Index refers to the Institute for Supply Management (ISM) Manufacturing PMI. SPX Index refers to the S&P 500 Index. Historical performance is not an indication of future performance and any investments may go down in value.

Why caution is warranted

The economic data is indeed encouraging and is a step in the right direction. It does not however amount to a V-shaped economic recovery. Investors should consider the following:

PMIs highlight the month-on-month change in economic activity. With the US (and the global economy) emerging from strict lockdowns, a sharp recovery in PMIs is not surprising.

The addition of around 7.3 million jobs in the US over May and June follows the loss of 20 million jobs in April. US unemployment in July is still extremely high at 11.1% and will return to more tolerable levels very gradually if the economy continues to improve.

Gross domestic product (GDP) growth figures for Q2 2020 and inflation numbers for June are likely to present a more sobering picture of the world compared to equity markets.

The pandemic is far from over and the US is experiencing a sharp increase in daily new cases since the middle of June.

Thus, even if the pandemic is overcome, the economic recovery is likely to be slow and steady. Investors should still be considering which equity exposures will add balance and robustness to their portfolios during the uncertainty which lies ahead.