Dr Svetlana Borovkova: Post-corona trends and their role in immunizing your investment portfolio

Dr Svetlana Borovkova: Post-corona trends and their role in immunizing your investment portfolio

We can speculate how the world will look like after the coronavirus epidemic. But some of the macroeconomic and consumer trends we can observe already now.

These trends will play an important role in success (or failure) of many companies, and hence, in the performance of portfolios invested in these companies.

Using alternative data such as sentiment and internet search behaviour, we at Probability & Partners have identified several of such emerging trends which I will outline here. In the second part of this column, I will show how companies can be scored in terms of these trends. These trends can be seen as new “investment factors”, and portfolios tilted towards these factors will be more immune and shock-resistant in the post-corona world.

The first trend is what we call Social Transformation. It stems from “fear” of social interaction and concerns about infection and disease. It is characterized by:

- Cautiousness in travel, mass gatherings, social contact;

- Interest in staying and buying local;

- New ideas about public space;

- Increased car and bike use (over public transport);

- Increased level of hygiene;

- Higher priority towards healthcare.

The second trend is Accelerated Digitalization. With a long period of working, exercising and entertaining from home, former barriers of doing things online are rapidly disappearing, and the chance is high that they are disappearing for good. So this trend is characterized by:

- Increased and rapid digitalization of work and services: remote working and communication, education, shopping, recreation (sports, entertainment);

- Less business-oriented travel (moving meetings and conferences online);

- Broader acceptance of online solutions and process automation;

- Increased importance of IT security;

- Change in balance between home and office space: bigger houses, fewer offices.

The third, very prominent trend is Sustainable Innovation. The size of government support packages for businesses is unprecedented, but it comes with strings attached. Businesses that make use of these packages will be required to operate in a significantly more sustainable way: the most prominent example of this is support packages for airlines. As a result, it is likely that the ‘business as usual’ economy will be displaced by fostering innovation: old-school, less sustainable companies will partly disappear while new, more environmentally friendly companies will emerge. So the characteristics of this trend are:

- Emphasis on sustainable transformation;

- Changing balance between customers vs shareholders interests;

- De-globalization (shorter supply chains, less global transport and import/export, increase in local production);

- Shift from growth-oriented to circular economy;

- More demand for sustainable consumer products.

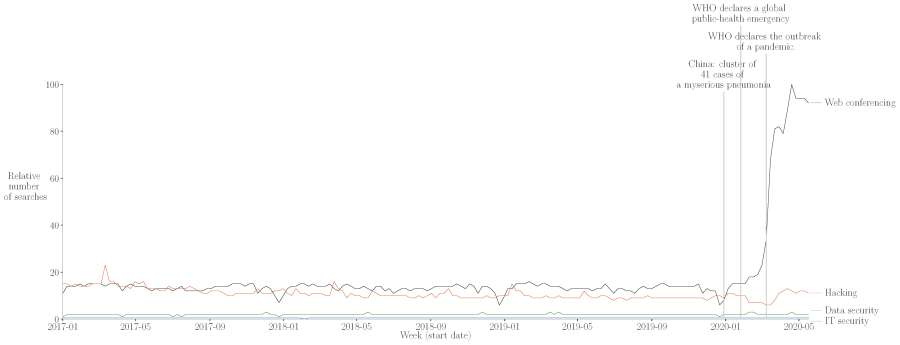

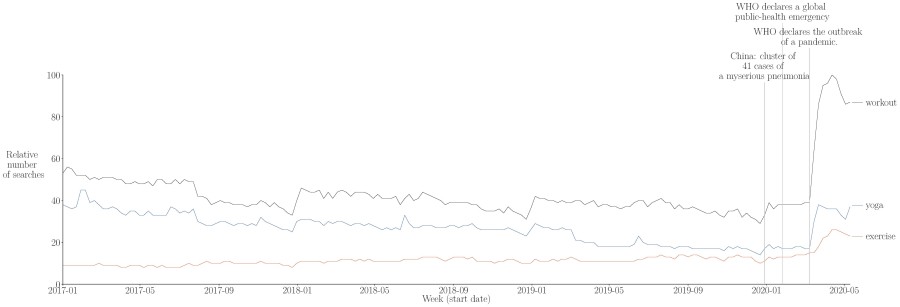

Evidence for these trends can be seen for example from internet searches for particular search terms. For example, the two graphs below illustrate the Accelerated Digitalization trend: they show the numbers of Google searches for “webconference” and YouTube searchers for “workout” “yoga” and “exercise”, which all surge around the start time of social distancing and lockdown measures, and do not return to their previous low levels. A wealth of similar examples can be shown to further illustrate this and other two trends.

These are just three of many possible trends; however, we believe (and alternative data provides us with evidence) that these three trends encompass the majority of the emerging consumer sentiment and hence, should be kept in mind when assessing future prospects of a company or an industry.

It is easy to identify sectors and industries that will do well (e.g., Health Care, Tech) or less well (Travel and Leisure) given these trends. However, investors should hold well-diversified portfolios, also across all sectors. So in the next instalment of this column I will show how individual companies can be scored in terms of these trends and how this scoring system can be used to “tilt” investment portfolios towards these new post-corona factors.

Probability & Partners is a Risk Advisory Firm offering integrated risk management and quantitative modelling solutions to the financial sector and data-driven companies.