MUFG Daily Snapshot – Volatiliteit neemt af, ook al is coronacrisis nog niet voorbij

MUFG Daily Snapshot – Volatiliteit neemt af, ook al is coronacrisis nog niet voorbij

G10 FX: Reversal price action remains dominant trend

The foreign exchange market has remained very stable during the Asian trading session with most major currency pairs largely unchanged. The Fed’s efforts to curb the surging US dollar have proved effective in the near-term and are also helping to dampen FX volatility.

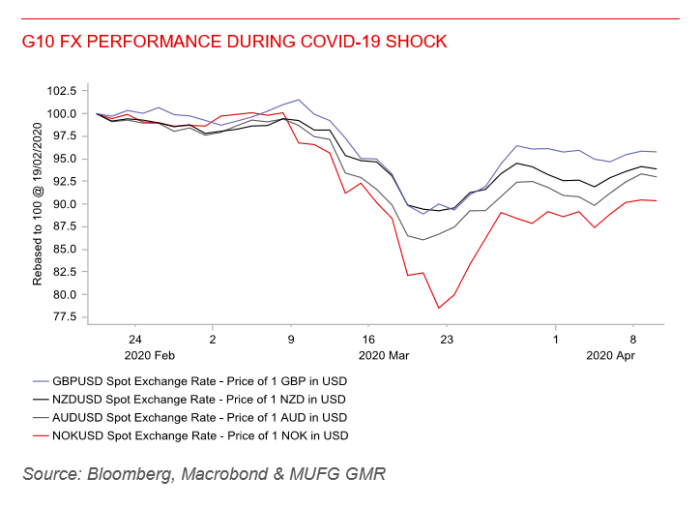

The biggest mover overnight has been the Indonesian rupiah which has strengthened by around 1% against the US dollar. Even high yielding emerging market currencies which have been hit hardest by the COVID-19 shock have started to rebound over the past week. In the G10 FX space reversals continue to be the dominant trend. The best performers since global equity markets bottomed in order have been the Norwegian krone, the Australian dollar, the pound and the New Zealand dollar, and the worst have been the US dollar, the Swiss franc, the euro and the yen. It is almost the exact reversal of G10 FX performance recorded during the global equity market sell off between February and March. During that period the worst performers were the Norwegian krone, the Australian dollar, the pound, and the New Zealand dollar while the best performers were the yen, the US dollar, the Swiss

franc, and the euro. The only currency which has strengthened during both the risk off and risk on period has been the yen but only modesty against the US dollar which leaves it largely unchanged year to date.

The current more risk on trend in the FX market which is encouraging the Norwegian krone, the Australian dollar, the pound and the New Zealand dollar to continue reversing prior losses has been supported by building evidence that the lockdowns are proving effective at slowing the spread of COVID-19 and on the back of reports that major oil producers are moving closer to an agreement for an unprecedented cut to oil production. So far all four currencies have retraced around 61.8% of the sell-off which took place between the 19th February and the 19th March. The main risks which could derail the current trend include: i) potential disappointment over the timing and scale of lockdown reversals/ oil production cuts and ii) the upcoming deluge of unprecedentedly weak economic data releases. Admittedly though, it does appear to be largely consensus now that the major economies will contract by between 5% and 10% in Q2. What happens during the 2H of this year could prove more important to altering market expectations.

USD: It’s Trump vs Biden for sure Bernie Sanders yesterday announced the suspension of his campaign to win the Democratic Party presidential nomination which gave the dollar a modest lift in the immediate period after the announcement. The S&P 500 was rallying when the announcement came and helped give it a further lift. The removal of Sanders as a risk now leaves us the option of four more years of Trump or a new term with a far more moderate Democrat. For the equity markets a more palatable prospect.

First and foremost Sanders bowing out was inevitable as he had no clear credible path to victory. But this announcement is certainly a positive for Joe Biden. While it looked very likely to be always him who would win, the race ending in early April rather than in June, as was the case in 2016 between Clinton and Sanders and in 2008 between Clinton and Obama, will give Biden a lift.

But the reality of this election is of course the COVID-19 has upended the way this plays out and is extremely unpredictable. The Wisconsin primary where voters were forced to take risks to vote is a sign of the extent of uncertainty over how the presidential election in November will be conducted.

Assuming that bad news on the economy means good news for Biden doesn’t really hold. There are though certainly greater risks for Trump and our assumption we outlined in January of a Trump victory over Biden in November is not as strongly held given current circumstances.

Two big questions will partly determine Biden’s prospects. Firstly, will the Democratic Party now unify around Joe Biden? If Sanders endorses Biden and the likes of Alexandria Ocasio-Cortez fall in behind, a unified Democratic Party stands a much stronger chance of winning. Secondly, how does Biden boost his support through a time of national crisis without being seen as divisive or disruptive to efforts to defeat the COVID virus?

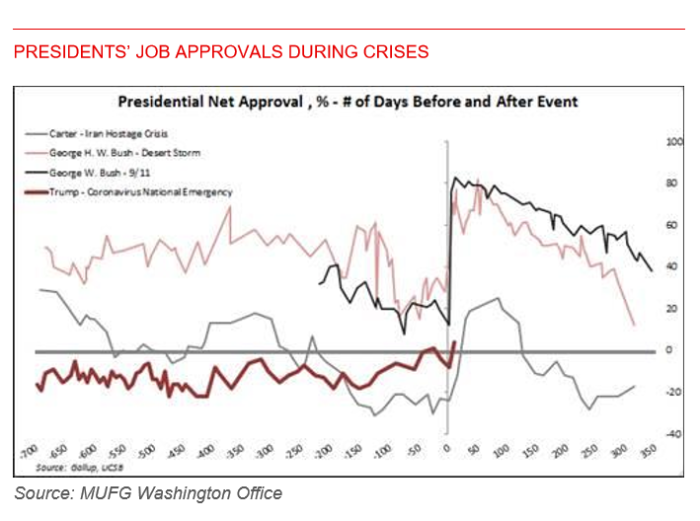

Presidents tend to do well during periods of crisis and this is partly why Trump’s approval rating has held up reasonably well. Hi approval rating has experienced a small bounce but it hasn’t jumped as much as expected based on the past performance of prior Presidents who have faced crises, as the chart above illustrates.

But for now for the markets, the election can only be viewed through how COVID-19 plays out. Will the election mean more postal voting is encouraged in order to boost turnout? Will joblessness remain high through to the election? Might there be a second wave going into winter ahead of the election? These are the factors that will determine the result so for now, COVID-19 developments and Trump’s actions will remain key for risk appetite and hence the dollar.

EUR: French economy to shrink by most since World War 2 The Bank of France has released their estimate for French GDP in Q1 and it provided clear evidence of the damage COVID-19 disruption is expected to have on the French and global economy. The Bank of France estimated that the French economy will contract by 6.0% in Q1. They used high frequency data including card transactions and requests for unemployment benefits to corroborate the results of its monthly survey of 8.5k businesses. The sharpest declines in activity were estimated to be in the automotive and machine-making sectors within industry, and hotels and restaurants within the service sector. The estimated loss of activity in the one week of confinement in Q1 was estimated at around 32%. It was similar in scale to Insee’s estimate of 35%. According to the Bank of France’s survey, factories were running at a record low of only 56% of capacity in March down from 78% in February.

The scale of economic weakness has prompted ECB President Lagarde to renew her plea for a strong fiscal response ahead of today’s second round of discussions over a joint EU response. She reiterated that “it is vital that the fiscal response to this crisis is undertaken with sufficient force in all parts of the euro area”, and acknowledged that there were troubling signs in recent economic indicators including the sharp deterioration of the labour market. Market expectations are low for an even more substantial joint EU response beyond current proposals including: i) allowing the ESM to provide credit lines of up to 2% of GDP, ii) creating a EUR100bn European Commission program to support work-supplement schemes in hard-hit areas, and iii) providing up to EUR200bn of EIB loan guarantees. Joint debt issuance still appears unlikely leaving it to the ECB support the peripheral debt market with purchases of just over EUR1 trillion this year under their asset purchase programmes. Unless there is a positive surprise today from EU policymakers, the euro is likely to continue to trade on a softer footing amidst the recent improvement in risk sentiment.