WisdomTree: Chinese equities appear safest amidst the COVID storm

WisdomTree: Chinese equities appear safest amidst the COVID storm

By Aneeka Gupta, Director, Research, WisdomTree

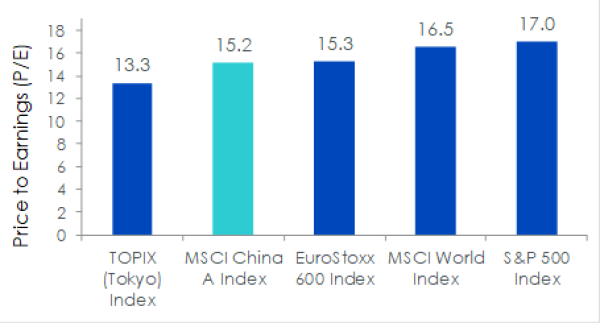

Chinese equities have emerged as a safe harbour posting a smaller loss of -10% in comparison to the US at -20% and Europe at –23% respectively in the first quarter of 2020[1]. Investors are starting to pay closer attention to Chinese equities as their valuations are attractive in comparison to the rest of the developed world on a Price to Earnings (P/E) basis. While the rest of the world continues to grapple with the COVID-19 epidemic, China is providing further evidence of a recovery after the new daily confirmed cases peaked in early February aided by its draconian lockdown measures used to contain the spread of the coronavirus.

Figure 1: Chinese equity valuations remain attractive relative to the rest of the developed world

Source: WisdomTree, Bloomberg as of 30 March 2020. You cannot invest directly in an index. Historical performance is not an indication of future performance and any investments may go down in value.

Gradual resumption of economic activity in China

High frequency data is continuing to improve highlighting China’s renewed priority of normalising activities. We have observed industrial sectors resuming at a faster pace relative to the consumer and service sectors owing to loss of employment and household income. Daily coal consumption is around 80% of the normal level, while 65% of migrant workers have returned to their place of work. Although mass transit journeys remain 70% below normal, strict quarantine arrangements are being loosened rapidly by local authorities across China. Overall consumption is at 85% of normal levels, while online spending is back to normal levels. However large ticket items like autos and home sales and travel related categories remain well below normal levels. Since auto retail sales account for 10% of total retail sales we expect to see further stimulus to help support demand.

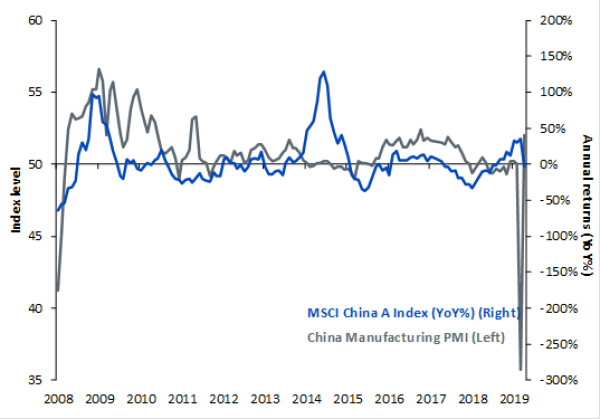

The economically important coastal province of Jiangsu is aiming for the full opening of all schools and colleges by April 13. Museums and some national restaurant chains that have been closed since late January are also beginning to re-open. After declining to a record low of 35.7 in February, the official Purchasing Managers Index (PMI) rebounded to 52 in March, according to National Bureau of Statistics, signalling that the world’s second largest economy is getting back to work.

Figure 2: Chinese A shares tend to benefit from PMI recovery

Source: WisdomTree, Bloomberg as of 31 March 2020. You cannot invest directly in an index. Historical performance is not an indication of future performance and any investments may go down in value. Please Note: A-Shares are securities of Chinese incorporated companies that trade on either the Shanghai or Shenzhen stock exchanges. They are traded in Renminbi (Chinese Yuan).

Additional policy stimulus needed to plug faltering external global demand

It is important to note that China’s recovery comes at the cusp of slumping external demand from the rest of the world. For this reason, investors will remain on the lookout for whether Beijing can kickstart the economy via appropriate monetary and fiscal policy. In February, the Chinese government has rolled out fiscal support of over 1.2trn Chinese Yuan (RMB) and indicated plans to issue special treasury bonds. However, these measures fall short of what we have seen outlined by other developed market economies.

The politburo meetings urged to “strengthen offsetting policies and effectively increase domestic demand” and “strive to achieve this year’s development goals”, signalling that the authorities will be taking stronger action to stabilize economic growth. In our view, more liquidity will be injected by the People’s Bank of China (PBOC) via both broad-based and targeted methods, such as reductions in the required reserve ratio and offering liquidity via targeted Medium Term Lending Facilities (MLFs) which work as the base for the one year Loan Prime Rate – the main reference rate for corporate loans. The People’s Bank of China injected 50bn yuan into the banking sector via its 7-day reverse repo facility on 30 March 2020 with the interest rate lowered to 2.2% from 2.45%.

Since the COVID-19 pandemic has taken its roots, the achievement of the first phase of the US-China trade deal at the end of 2019 looks like a distant memory. The reality is Chinese equity markets ended 2019 on a firm footing. Despite ongoing strong headwinds – weak global external demand, lower domestic consumption, further supply disruptions, we expect China to see a rebound in GDP by the second quarter of 2020 supported by additional fiscal and monetary stimulus measures.

Unless otherwise stated, data source is Bloomberg, as of 30 March 2020.