MUFG Daily Snapshot: Fed continues to act where it can

MUFG Daily Snapshot: Fed continues to act where it can

By Derek Halpenny, Head of Research, Global Markets EMEA & International Securities

USD: Fed opens another channel for supplying dollars

The spot market yesterday was indicating renewed upward pressure on the dollar despite all the actions taken by the Fed in recent weeks to try and provide greater balance to USD supply and demand. Month, quarter and fiscal year-end flows may have played a role in yesterday’s USD demand but nonetheless, the Fed took further action to address access to US dollars. The decision to launch another facility – the Facility for Foreign & International Monetary Authorities (FIMA) Repo Facility – looks to have been twofold. Firstly, it provides central banks abroad with another avenue to access US dollars for their local jurisdictions by allowing central banks to repo their UST holdings for cash. Secondly, it means these central banks to not have to sell UST bonds outright to raise cash.

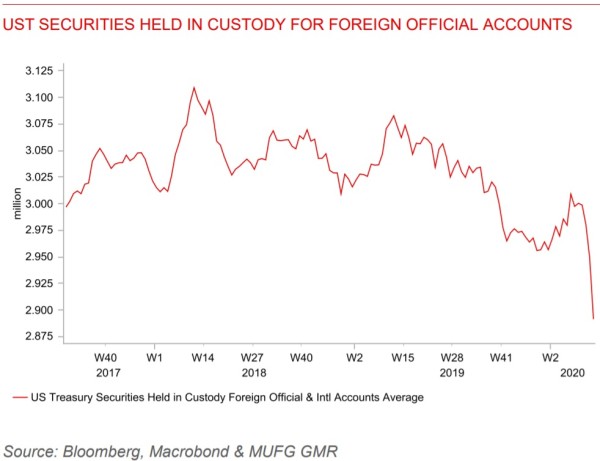

The Fed explicitly cited that the action was to “support the smooth functioning of financial markets, including the US Treasury market”. The chart bellows illustrates the scale of UST bond selling by foreign central banks in recent weeks and the Fed clearly wanted to alleviate this upward pressure on rates that could compromise the smooth transmission of monetary policy. In 3 weeks, these entities sold over USD 100bn worth of UST holdings. Now any foreign official entity with an account at the Federal Reserve can use those holdings as collateral in repo operations to obtain cash. The facility will be active from 6th April for six months.

One benefit of this facility is that it can be accessed by a wider number of central banks – the USD currency swap lines helped only a specific number of central banks – the major central banks along with an additional nine announced recently. Any central bank with an account with the Fed can use this facility and does not now have to liquidate their UST holdings.

The step will reinforce the USD swap line facility that continues to be utilised and has eased the cost of obtaining dollars. The BoJ provided a further USD 29.7bn of dollars yesterday, taking the total to USD 133.8bn over three weekly 3-month auctions in the last two weeks. The ECB has provided a total of USD 176.3bn in two 84-day operations and numerous 7-day auctions since 18th March. Take-up at the BoE and the SNB has been less but nonetheless, these USD injections will continue to act against sustained dollar strength over the short-term.

G10 FX: Grim reality of US COVID-19 outlook unsettles markets again

The World Health Organisation’s acknowledgement on Monday that there was better hope that Europe may be reaching a peak in the crisis was in contrast to the shift in tone in the US yesterday when President Trump appeared to accept the worsening situation. The administration stated that deaths would range between 100k and 200k.

The latest projection in the US showed a sudden spike in April from 4,500 deaths to almost 60k with a move further higher into August of 84k. 2,200 deaths per day are predicted by mid-April. The communication from Washington was underlined by the jump in deaths – a 29.0% increase was recorded yesterday, up from 21.6% the previous day. The 5-day average picked up to 25.8%.

The situation in Europe, while better than in the US, darkened a little yesterday with a more mixed day. The better news remained in Italy and Spain with growth in new cases and deaths slowing again to new lows since the breakouts. However, new cases growth in France, Germany and the UK picked up while the growth in death rates picked up in Germany, Switzerland and the UK. The UK jump in deaths of 381 was the largest yet with the 5-day average daily growth rate picking up to 25.6%. The death total more than doubled in four days. The ONS also confirmed that the daily NHS data could be missing as much as 20-25% of deaths that do not take place in hospitals based on wider ONS data on COVID deaths compiled up to 20th March.

What is clear from the projections in the US and the less favourable day in Europe yesterday is that projections of a return to normal by the end of Q2 for many economies may soon be questioned by investors. Most lockdowns in Europe are set to be in place until after Easter or to the end of April. At the very least, the reversal of lockdowns may prove to be slower than expected.

This is especially so given the COVID-19 data is now showing a pick-up in the growth of new cases in Asia where the virus first hit. The 5-day average increase in new cases in Japan hit 10% yesterday, the highest level since 11th March. In the Philippines the growth rate hit 31%, the highest rate since 17th March. The lesson from Asia appears to be vigilance is required for a considerable period of time.

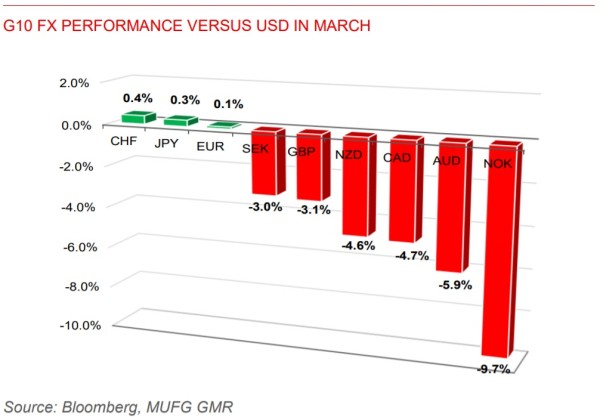

CHF: Swiss franc the top G10 FX in March despite huge intervention

Asian equities are generally lower today with US equity futures down around 3%. Investor sentiment will remain fragile with the outlook for the spread of COVID-19 uncertain. Developments of late suggest increased risks of another correction lower in risk which will ensure continued support for the dollar. Remarkably, EUR/USD closed the month of March close to unchanged from the end-February close.

The Swiss franc slightly out-performed as the top G10 currency, +0.4% versus the dollar with the yen 2nd, up 0.3%. That CHF outperformance comes despite what looks like the largest intervention by the SNB since January 2015 when the EUR/CHF floor at 1.2000 was abandoned. Total sight deposits in Switzerland jumped to CHF 620.5bn, over CHF 24bn larger than at the end of February. We can safely say that Switzerland has smashed the 3rd US Treasury criteria for being cited as a “currency manipulator”. That 3rd criteria is spending over 2% of GDP on one-way intervention. The March jump in sight deposits equates to about 3.4% of Swiss GDP. Trump’s focus is elsewhere at the moment, but no doubt at some point his attention will shift. Switzerland, according to the US Treasury department already meets the other two criteria for being cited as a currency manipulator.