NN IP: Corporate Green Bonds: an attractive alternative to regular corporate bonds

NN IP: Corporate Green Bonds: an attractive alternative to regular corporate bonds

- As the green bond market booms, NN IP adds a corporate variant to its green bond fund range

- Corporate green bond segment is becoming larger – more liquid, more diversified

- Regular bond investors can greenify their corporate bond exposure and benefit from attractive returns

The green bond market is growing rapidly and becoming more diversified, especially the corporate segment. Corporate green bonds are also becoming increasingly attractive purely from a financial and risk-return perspective. As the market continues to mature, investors will seek a broader range of green bond options which is why NN Investment Partners is launching a new dedicated corporate green bond fund – NN (L) Corporate Green Bond. A fund which offers a green bond option for pure credit exposure.

Prior to the fund’s launch, we sat down with green bond portfolio managers Bram Bos and Jovita Razauskaite to find out more about why NN IP is launching this fund and what benefits it can offer to investors.

Why a corporate bond fund and why now?

The growth and increasing diversity of the green bond market, especially the corporate segment, is an important factor in the timing of this launch. The market really took off in 2019, growing by an impressive EUR 181 billion to EUR 507 billion. It is now larger than the European high yield market, for example, in terms of volume. And this makes it a fully-fledged fixed income segment in its own right. We are positive this growth is set to continue and expect new issue volume for both sovereign and corporate issuers to remain high in 2020. As the market continues to mature, investors will seek a broader range of green bond options.

Although sovereign issuance remained strong in 2019, with the Netherlands, France and Ireland tapping the market, corporate issuers dominated the green bond market. And in contrast to previous years, the issuer base became increasingly diversified. More industrial, communication and technology companies turned to the green bond market to finance green projects, including household names like PepsiCo[1]. The first insurers also issued green bonds and, in our opinion, car manufacturers transitioning to low-carbon solutions could well be next. This increase in corporate issuance and its effect on the market’s breadth and liquidity make now the perfect time to launch a dedicated corporate green bond fund. A fund which offers a green bond option for pure credit exposure.

What are the characteristics of the new fund and who is it for?

Our new corporate green bond fund will follow the same strategy and apply the same investment principles as our other green bond funds. It applies the same stringent selection criteria to determine the investment universe and takes a high-conviction view on the investment candidates from a fundamental perspective. The fund will invest in around 100 issues and its benchmark is the Bloomberg Barclays MSCI Corporate Green Bond Index. The costs will be similar to those of our regular NN (L) Green Bond fund[2], and the new fund will launch with assets from both existing and new clients.

This step also further expands our green bond product range. In addition to our flagship NN (L) Green Bond fund, which invests in sovereign and corporate green bonds, we launched a short-duration green bond fund (NN (L) Green Bond Short Duration) in 2019. This fund has a duration of two years and caters to investors who want to invest in green bonds and at the same time seek protection against rising interest rates. The combined assets in NN IP’s green bond strategies and mandates now amount to around EUR 2.4 billion in total.

How does the financial performance compare to regular corporate bond investments?

We see green bond investments as a sustainable alternative for regular fixed income allocation. We believe that having a positive environmental impact can go hand-in-hand with financial performance. This means that all investors who allocate to corporate bonds can consider NN IP’s Corporate Green Bond fund as an alternative. The corporate green bond market capitalisation is now around EUR 210 billion and expanding rapidly. The diversification across countries is similar to that of the regular corporate bond index, and average credit rating, yield and duration are also increasingly aligned.

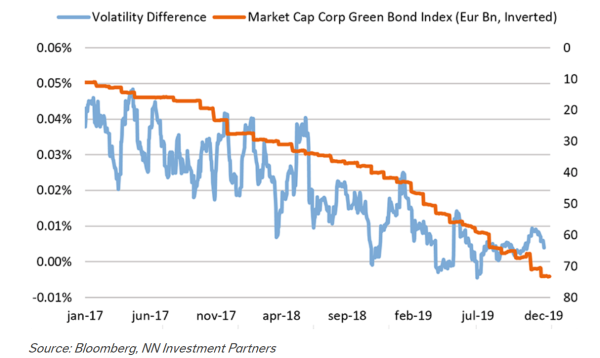

Our recent analysis of the performance of green bond indices[3] compared to regular bond indices also makes a compelling argument for green bonds in a broader context, not just for investors with a specific impact focus. This is particularly evident in the case of corporate bonds, where the volatility of the green bond index has consistently moved closer to that of a traditional bond index. This means that corporate green bonds are becoming increasingly attractive purely from a financial and risk-return perspective, making them an interesting alternative for or addition to a traditional credit portfolio. In this sense the green bond market is entering the mainstream.

Daily volatility difference – corporate bonds vs corporate green bonds