NN IP Market Review: Bulls infected by a virus

NN IP Market Review: Bulls infected by a virus

- January was characterised by two shocks, with a divergent impact on asset classes

- US growth stocks did best while commodity-related assets suffered from growth fears

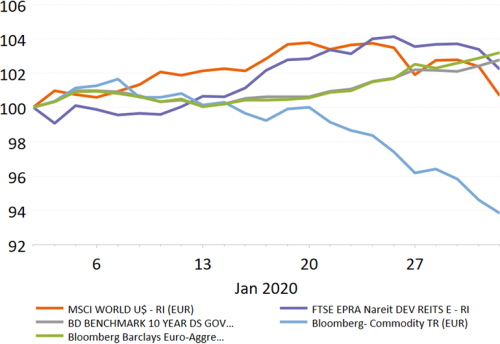

Asset class performance varied widely in January. The month began with a strong start for risky assets, driven by improvement in the macroeconomic fundamentals, hope for a strong earnings season, positive flow and price momentum, a first-phase trade deal and expectations of continued easy monetary policy. A geopolitical shock early in the month (the US strike in Iraq that killed Iranian general Qassem Soleimani) led to a sharp rise in the oil price, but equity markets appeared unfazed and the oil price soon fell below end-2019 levels. Subsequently, markets caught a cold with the outbreak of the coronavirus in China. Drawing parallels to the 2003 SARS outbreak, investors rushed into safe assets and dumped the more sensitive cyclical assets.

Commodities fared the worst by far, with the global commodity index dropping 7%. In particular, oil and industrial metals declined, owing to their sensitivity to Chinese demand and global growth. Safe treasuries on the other hand did well. The US 10-year yield fell by almost 40 bps to levels not far above the trough of August 2019. On the other hand, fixed income spreads did not fare well, with weakness for global high yield in particular. Despite the increase in risk aversion, global equities did fairly well in euro terms. This performance was fully attributable to the US market, where a string of strong earnings data saved the day. Global real estate also did well, driven by the sharp decline in bond yields and strong housing data.

Figure 1: Year-to-date asset class performance (EUR)

Source: Refinitiv Datastream, NN Investment Partners

Equities

Equity regions

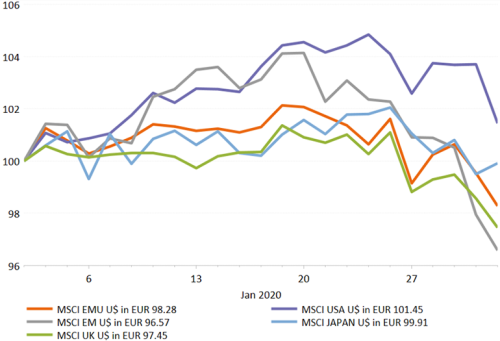

The two shocks that occurred in January – one geopolitical, one health-related – were big enough to turn our view on the market upside down. Emerging markets, which are in the midst of the virus scare, corrected the most. This did not come as a surprise given that China, which is the epicentre of the outbreak, represents 35% of the MSCI Emerging Markets Index. Emerging markets will experience an as-yet-unknown growth slowdown following the Chinese government’s aggressive measures to contain the virus. On the other hand, the US market will build on its strength, driven by a good start to the earnings season, the performance of the technology sector and its relative safety in the current environment.

Figure 2: Regional equity performance (EUR)

Source: Refinitiv Datastream, NN Investment Partners

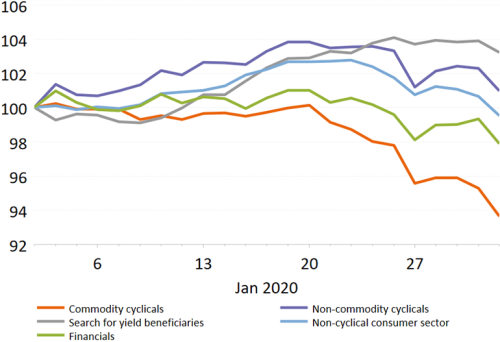

Equity sectors

In sector terms, an odd couple outperformed in January: technology and utilities. The tech sector’s outperformance was driven by the strong earnings season and by the investor appetite for growth stocks. On the other hand, the value-oriented utilities sector benefited from the sharp drop in safe bond yields. This benefited the bond proxies at the expense of financials, which continued to underperform the market despite strong results for US financials. The worst-performing sectors were the commodity sectors of energy and materials. The former was also hurt by weak earnings reports from some of the majors, which put their dividend policies into doubt.

Figure 3: Equity performance by sector (local currency)

Source: Refinitiv Datastream, NN Investment Partners

Fixed income

Government bonds

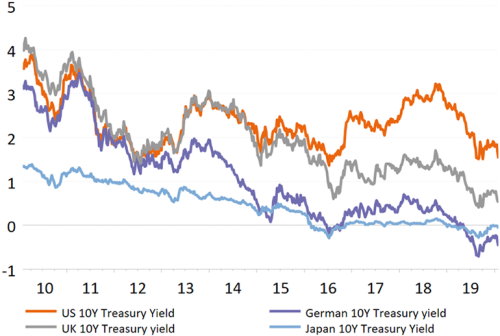

The health scare and the severe containment measures taken by the Chinese government have sparked a flight to safe assets. They have also raised questions regarding the impact on economic growth in China and globally. US Treasury yields dropped by 40 bps and the German 10-year Bund yield fell by about 30 bps.

Figure 4: Long-term government bond yield trends

Source: Refinitiv Datastream, NN Investment Partners

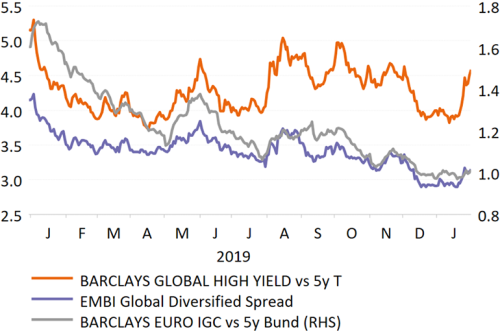

Fixed income spreads

The drop in risk appetite had a big negative impact on riskier fixed income products. The high yield market was especially weak, widening more than 60 bps. Spreads in other credit segments also widened as investors sought the safety of government bonds.

Figure 5: Credit spreads

Source: Refinitiv Datastream, NN Investment Partners

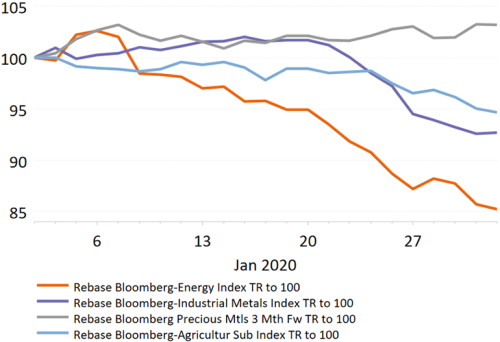

Commodities

Commodities fell sharply in January as the coronavirus spread. Fears that commodity demand will suffer had the biggest impact on the cyclical segments energy and industrial metals. In particular, commodities with the most exposure to Chinese demand fell. Precious metals, meanwhile, were supported by a safe-haven bid.

Figure 6: Commodity subgroups

Source: Refinitiv Datastream, NN Investment Partners