Ebury: How has the US-Iran flare-up impacted the FX market?

Ebury: How has the US-Iran flare-up impacted the FX market?

The targeted drone attack sanctioned by President Trump on Baghdad, which caused the death of Iran’s most powerful military leader General Qasem Soleimani, has made for an eventful start to the year. A further escalation in the conflict has followed, with Iran launching a ballistic missile attack on US troops in Irbil and Al Asad, Iraq, on 8th January. While Trump warned of ‘major retaliation’ should Iran reciprocate with military action of its own, Iranian Foreign Minister Mohammad Javad Zarif appeared to draw a line under the matter in a recent Twitter post. Trump himself stated on Wednesday that Iran ‘appears to be standing down’, while seemingly calling for a de-escalation in the conflict.

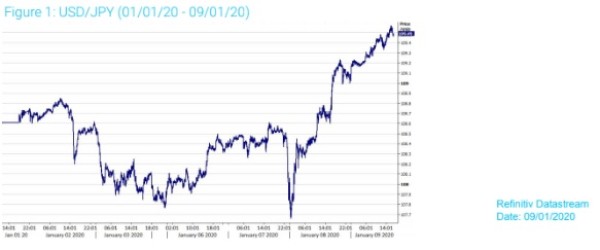

As is customary during times of financial market stress, safe-haven assets gained in value. The favoured safe-haven of gold leapt to a near seven-year high, while in the currency markets, the Japanese yen and Swiss franc both appreciated, the former briefly surging to its strongest position since October (Figure 1). It is worth noting, however, that the yen has since given up the entirety of its gains and is now actually trading lower year-to-date. Investors do not, as of yet, appear overly concerned by the situation, given the fairly limited nature of negative headlines since the initial attack.

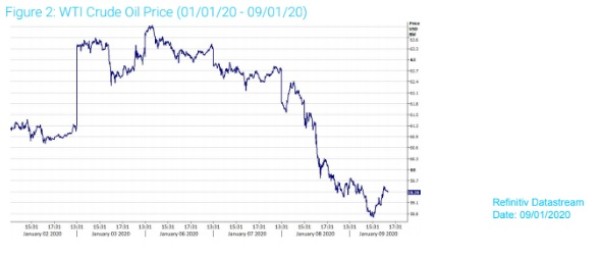

Emerging market currencies were broadly weaker as investors fled those currencies deemed as higher risk, although again the moves have been relatively muted with most of the sell-offs limited to less than one percent. Those heavily oil-dependent currencies initially benefited from the news, given that it induced a sharp move higher in global oil prices of around 4%, although these moves have since been retraced (Figure 2). Iran currently holds around 10% of the world’s total oil reserves, so it comes as little surprise that supply fears pushed up the price of the commodity to this extent.

As for the US dollar itself, the currency is currently trading higher year-to-date in trade-weighted terms, in part due to the aforementioned safe-haven flows. Measures of volatility in the critical EUR/USD pair have, however, actually remained pretty subdued, again suggesting that currency traders are not overly concerned by the recent flare-up.

Tensions ease, but what could happen next?

It’s clear that if a significant escalation in the conflict or all-out war between the two countries was realistically in the offing we would have seen a more meaningful reaction in the FX market. USD/JPY, in particular, would have reacted with a much more aggressive downward move than we have witnessed thus far in 2020. As mentioned, these moves have so far been contained and pretty limited in nature, with the cross now actually trading around three-quarters of a percent higher year-to-date following Trump’s speech on Wednesday.

In the unlikely event that the low-level conflict between the US and Iran ratchets up to anything more severe, we would expect an exacerbation of the moves that we witnessed following the initial attack on Baghdad. Investors would flood to the safety of the Japanese yen and Swiss franc, while selling hard those emerging market currencies that are net importers of oil. We would also likely see a weakening in EUR/USD as investors dump those G10 currencies deemed as higher risk, the common currency being one of those.