Morningstar: Understanding the Emissions Challenge for Integrated Oils Companies

Morningstar: Understanding the Emissions Challenge for Integrated Oils Companies

As the world's largest oil and gas producers, integrated oils companies are increasingly coming under pressure from investors and regulators to reduce emissions. Key to understanding the sustainability of integrated oils is determining their ability to reduce emissions to satisfy regulators and investors as well as manage its transition to a lower carbon world. There is also the risk of investors voting with their feet well before there is global governmental consensus on regulation, which is likely what integrated oil management teams view as the more immediate threat.

The latest Energy Observer from Morningstar’s equity research team looks to demystify the global emissions challenge and the actions that companies like Shell and Total can take to improve their greenhouse gas (GHG) emissions.

Highlights of the Energy Observer include:

• Integrated oils largely recognise the need to reduce emissions and have adopted targets to do so. However, on average 90% of integrated oil GHG emissions are Scope 3, those that occur during combustion as a result are beyond the companies’ control. Shell, Repsol and Total have the most comprehensive encompassing GHG reduction ambitions which include Scope 3.

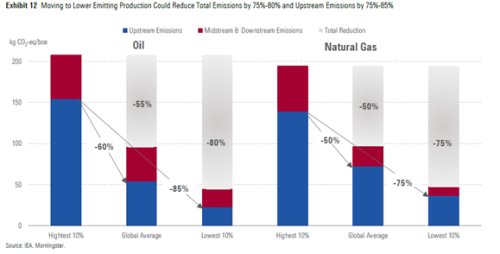

• Increasing natural gas production can help improve total emissions intensity for those seeking to do so such as Shell and Total. However, greater natural gas production can help, but alone, it won't be enough to meaningfully reduce emissions intensity.

• Flaring, which is responsible for 23% of GHG emissions, is a key opportunity to reduce emissions while increasing revenue. For integrated oils, flaring is largely an issue in the U.S. (Exxon) and Africa and Asia (Chevron, Eni). However, efforts to reduce routine flaring by building out gas infrastructure are paying dividends and we expect flaring level to continue to fall given commitments by management teams and favourable economic incentives.

• Methane comprises only about 5% of integrated oils operated emissions on average but given its greater global warming potential and opportunity for economic recovery, it’s a key opportunity area.

• Integrated oils’ ambitions to enter renewable power generation vary widely, with Shell, Total, Repsol and Equinor leading the way. Increasing renewable generation could be the most effective way for integrated oils to reduce their emissions intensity.