Monex: Markten gaan uit van renteverlaging Fed

Monex: Markten gaan uit van renteverlaging Fed

Volgens Bart Hordijk, valuta-analist bij Monex Europe gaan de markten uit van een renteverlaging door de Fed in september. Maar zo zeker is dat volgens hem eigenlijk nog niet.

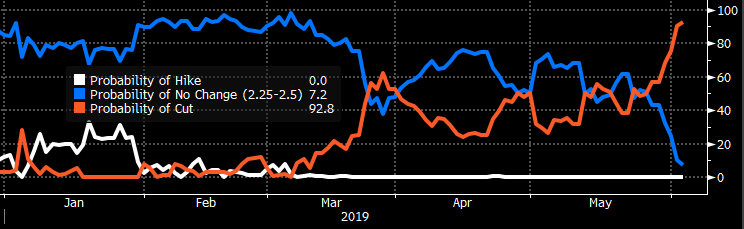

Hieronder volgt een commentaar in het Engels van Bart Hordijk, valuta-analist bij Monex Europe, op de financiële markten die een renteverlaging in de VS in september inprijzen. Lagere inflatie, handelsoorlogen en een Amerikaanse economie die lijkt af te remmen; allemaal redenen waarom markten rekening houden met een dovish Fed. Voor september wordt de kans op een renteverlaging vrijwel als een zekerheid gezien met een kans van 92%.

Dit lijkt echter op een overreactie, aangezien er genoeg argumenten zijn aan te voeren waarom een meer afwachtende houding van de Fed op dit moment logischer is.

'Get ready for another episode of Federal Reserve versus markets this week. Markets price in a Federal Reserve rate cut in September as a near certainty at more than 92% after a breakdown in trade talks, a fall in inflation and a likely slower growth pace in the US. This has already led to the first call for Fed rate cuts on the short run by St. Louis Fed President James Bullard, however, as he is one of the most dovish Fed members this should be discounted somewhat. There are many good reasons to believe markets got far ahead of themselves and that a neutral Fed stance is more likely than a dovish bias.

In the latest Federal Open Market Committee press conference Fed Chair Jerome Powell still signalled confidence in the Fed reaching its inflation target, as he sees the recent dip in core inflation caused mostly by “transitory factors”. This resembles the situation mid-2017 when then Fed Chair Janet Yellen blamed transitory factors as well for the weaker core inflation. Yellen eventually won this standoff with markets as inflation picked up in the back end of the year and history may repeat itself this year under Powell’s guidance.

Also, one of the main reasons for a higher priced-in market expectations of Fed rate cuts are trade war fears and how this may hurt the US economy. However, on the short run the impact of trade tariffs may mostly be inflationary. Investment bank Goldman Sachs even calculated the full implementation of these tariffs on China may add another 0.5% to inflation, which would bring the core inflation back on the Fed’s 2% target as current core inflation stands at 1.6%. Besides, US growth is coming from a high base with an annualized GDP growth of 3.2% in Q1, implying the US economy may still be able to produce inflation if it slows down somewhat. Add to this that unemployment figures are at multi-decade lows, while wage growth hovers around peaks last seen in 2009 and it suddenly starts to look like premature for the Fed to already pull the cutting lever already.

Coming week can therefore prove vital for the dollar with a total of 13 Fed speakers next week. Unless Powell quite explicitly opens the door for a Fed rate cut on the short run, it may be markets who are caught short with their early bird’s bets on Fed cuts.'

Chart 1: Future market implied pricing of Fed rate cuts for the coming September meeting