BNY Mellon: Brexit: Tuesday Update

BNY Mellon: Brexit: Tuesday Update

By Simon Derrick, Chief Currency Strategist

- No agreement yet on an approach to Brexit that UK parliament can support

- Strong messaging from key EU politicians ahead of summit meeting

- Limited options given the time currently available

With the UK PM Theresa May heading to Germany and France for pre-summit meetings it's appropriate to look at the latest state of play on Brexit.

Headlines

- Germany’s EU minister Michael Roth says: "I must unfortunately note that the conditions set by the European Council at its last sitting have not been met. That means that the deadline will expire on April 12." He adds: "We are waiting finally for substantive steps in the right direction. Up to now nothing at all has changed. We are of course thinking about an appropriate extension of the deadline and also about a longer extension. They must, however, come with very strict conditions." He continues: "We are in a very, very frustrating situation and the European Union must ultimately get on with matters about its own future. We must also possibly give the British time to finally clarify what it is that they actually want. Apparently the discussions with the British opposition, which were begun very late, have not led to any substantial progress."

- France’s finance minister Bruno Le Maire says (when asked whether a no-deal was inevitable): “I prefer an agreement. But Theresa May should give us the reasons why she wants the delay and these reasons must be credible."

- Ireland’s foreign minister Simon Coveney says: "Everybody this week are open to an extension but they certainly want to see a plan attached to that extension."

- Labour leader Jeremy Corbyn says (regarding cross party talks on finding an acceptable approach to Brexit): “Talks have to mean a movement and so far there's been no change in those red lines.”

Thoughts

After six days (and despite what appear to be good intentions on both sides) there is still no agreement between the two main UK parties on an approach to Brexit that can pass a vote in the UK parliament. In the absence of this the UK PM is heading into pre-summit meetings today with Germany and France with little more to offer than a promise that if the UK is given a further extension then it will use the time constructively.

The response from Germany, France and Ireland (and others) has been robust: The UK hasn’t done enough so far to avoid exiting the EU without a deal, possibly as soon as Friday (although there is the hint of maybe a short extension). While it’s certainly possible that this is pre-summit rhetoric, it’s equally possible that this was no more than a very direct statement of fact. Given this it seems there are three reasonably possible outcomes (and one that seems a little less likely).

1. A cross party agreement is reached at the last minute. Parliament subsequently votes quickly to pass the withdrawal deal. The EU accepts the plan and the cliff edge is avoided. While this is certainly possible the question that remains is that if the UK’s Conservative and Labour parties couldn’t resolve this in six days then what are the chances of it being resolved today?

2. No cross party deal is struck and the EU says no to any further significant extension (although a very short additional extension might be agreed). The UK parliament then presumably votes (possibly as soon as Thursday or Friday) on leaving with no deal or revoking article 50. It votes to leave with no deal.

3. Same as two except parliament votes to remain.

4. Indicative votes take place in Parliament that see a majority emerge in favour of one option. The EU accepts this plan. Given timing issues this seems relatively unlikely at present.

How might Parliament vote if it’s a choice between a no-deal Brexit and revoking article 50 should it be put to them?

It is unclear how such a vote would play out. Perhaps the most direct indication comes from Monday of last week. When a proposal that would have seen Parliament given the power to avoid no-deal by cancelling Brexit if no extension was granted by the EU beyond the current 12 April deadline was put to a vote it was defeated by 292 to 191. However, it is also worth considering that on Wednesday a bill was passed that forces the PM to ask for an extension of article 50 from the EU should the alternative be a no deal Brexit (in the event the PM has approached the EU anyway). The bill passed by 313 to 312.

GBP

GBP remains at almost exactly its post referendum average against the USD. Oddly enough, that seems appropriate if the market is starting to think there is a chance of a vote between a no deal Brexit and revoking article 50 (i.e. the price that most fairly reflects the lack of certainty). This therefore suggests that any significant development in any direction (and almost all developments now will be significant) could have a substantial impact.

Given this it’s worth highlighting that prior to December the sharpest post referendum decline over a two day period (once the initial volatility had subsided) came at the time of the flash crash in October 2016 (2.5% close/close) while the post referendum drop was a record breaking 11% (easily beating the previous record of 6.2% set at the time of the collapse out of the ERM in September 92).

FX Derivatives

One month atmf implied volatility for GBP/USD has fallen sharply since the start of the month, possibly reflecting both the increasingly tight range the pair has found itself in (essentially zeroing in on the post referendum average). However, this still seems odd when 21 day realised volatility stands around 120 bps above the one month price (it stands at close to the highest levels since February of last year).

EUR

Given the fragile state of growth in core eurozone nations right now, it seems reasonable to say that a messy Brexit could have an unwelcome knock-on effect at the worst possible moment. It’s also possible (though harder to evaluate) that there may be concerns over how events in the UK might impact politics within the EU overall.

While it might seem far-fetched to argue that the EUR is displaying modest levels of contagion concern, it’s worth recalling that in the immediate aftermath of the referendum in 2016, markets in Italy and Spain (among others) were hit hard. This came despite a broad feeling before the vote that Brexit was an isolated phenomenon with little impact outside the UK.

There is also the straightforward observation to be made that since the start of 2017 the two major moves that emerged came in the aftermath of political events: the first round of the French presidential election and the formation of a government in Italy. It is therefore perfectly consistent that the EUR would prove sensitive to political concerns now - even if offshore but closely connected.

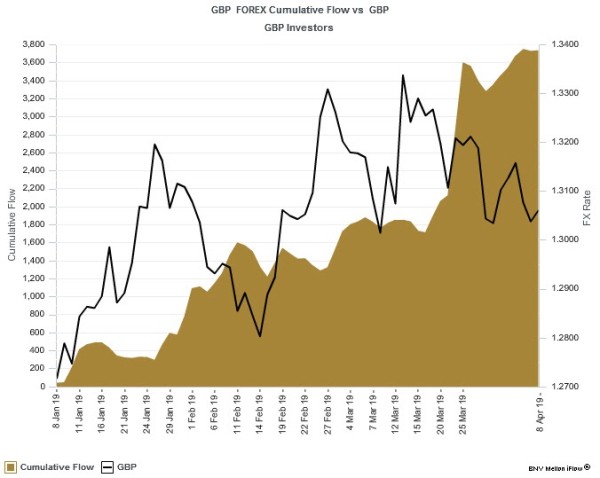

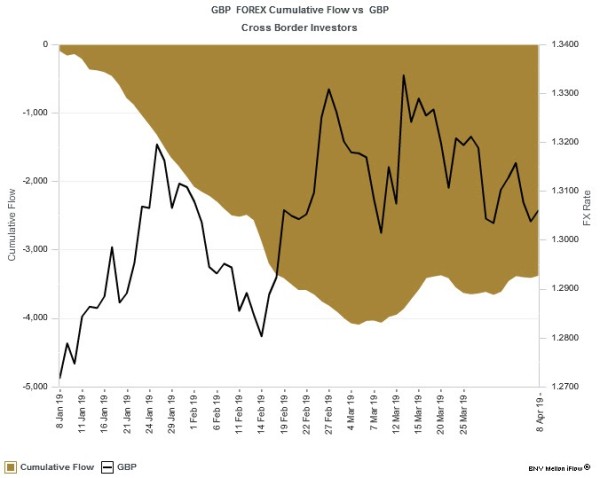

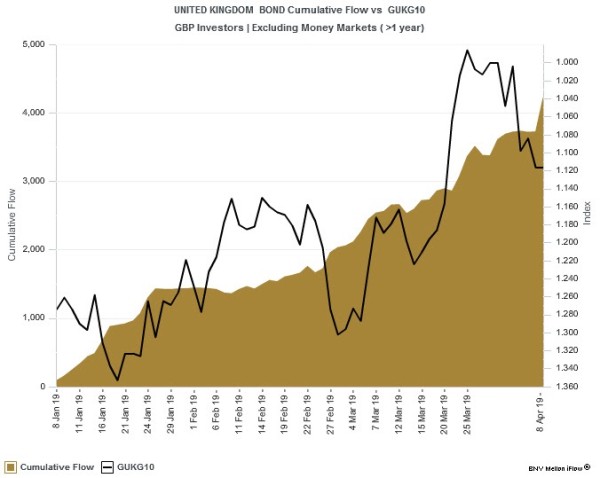

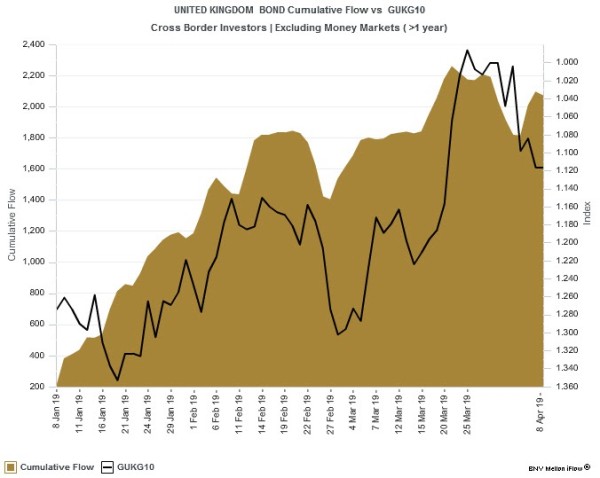

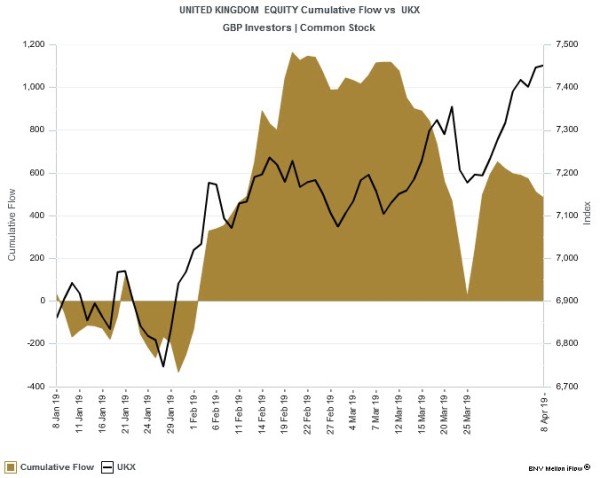

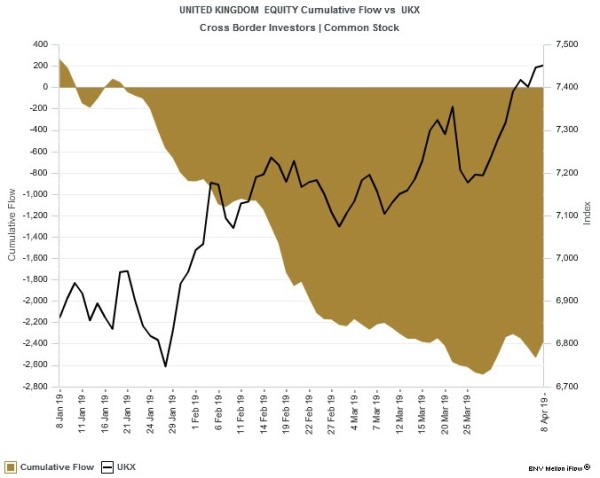

Flow

The recovery in GBP buying noticeable since March 8 continues although there has been some moderation since late last week. However, most of this buying appears to have come from domestic investors. A similar picture emerges for fixed income with buying of UK bonds from domestic investors evident while cross border buying appears to have dried up since Mar 21. For equities much of the outflows of foreign capital appears to have subsided since the end of last month However, domestic interest has been fading in recent weeks. (see charts below)